- Published on

Setting up a fast and reliable UPI stack

- Authors

- Name

- Akash Milton

- @mil10akash

There are about 150 UPI apps in India. Years ago, choosing one was hard. But is there any difference? Isn't the underlying work the same for all? Aren't they just different flavours? True to some extent, but some of these apps provide some extra functionality over or along with UPI, which sometimes is a huge differentiating factor, and this integration of these functionalities made me call it a stack. This stack makes payments easier, and that is what this blog is about.

Isn't basic UPI enough?

UPI is great; I'm a big fan of it, but still, due to its design, it has some downsides. First of all, UPI involves two bank servers, two client app servers, and a UPI server. These hops are also making it a little slow. Let's say 3 to 5 seconds, and if you take the time taken to type the PIN, it would be roughly 10 to 15 seconds, which is as fast as taking cash from your wallet. At least being slow is fine, but sometimes the servers will be busy and you can't make a transaction, so reliability becomes a question here.

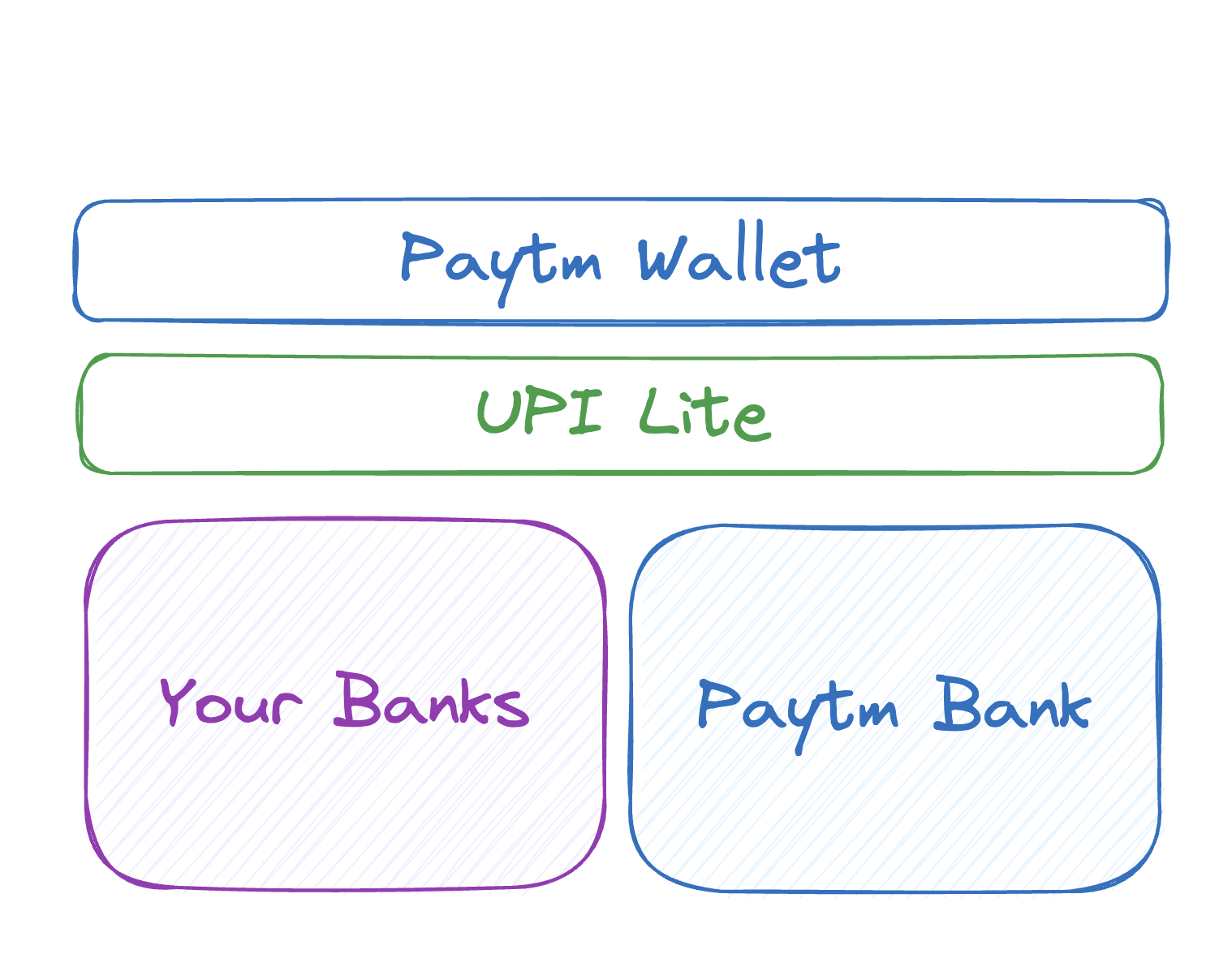

Recommended Stack

The way it works is that you will do the setup, and when you do a payment, based on the merchant, payment amount, and your last payment preference, the app, by default, will decide the most appropriate thing to pay from, which you can also override at the payment level.

1. Paytm Wallet

Unlike UPI transactions, which require five parties to complete a transaction, wallet transactions only require one party, the wallet provider. In comparison to a regular UPI payment, this is extremely fast. Furthermore, you do not have to enter the PIN for the wallet transaction, making things more convenient and quick. So, if you scan the UPI QR code of a merchant who has also connected his wallet, you are eligible for a transaction through the wallet, and most merchants have enabled this as far as I can tell.

There is an option to automatically recharge your wallet when the amount goes below a certain point. So you don't have to bother about recharging it regularly. Also, your bank entries won't be polluted by these wallet transactions, which is quite an advantage. Moving money from your wallet to your bank will incur some charges, but assuming you aren't loading a lot into the wallet, you don't have to worry about this.

2. UPI Lite

UPI Lite is UPI's own wallet system. As this does not necessitate the use of a PIN, it is faster, and because of the way it works, it is more dependable than regular UPI transactions. Though currently it can only be used for transactions less than ₹ 500 and can hold only up to roughly ₹ 2000, it is a great fit for many of the small value transactions where the merchant doesn't have a Paytm wallet implementation. Certain features like automatic recharging haven't landed yet, but I'm expecting them soon.

3. Paytm Bank

You can easily create a bank account with Paytm. This has some advantages over your regular bank account, like the fact that you can make UPI transactions with it with your fingerprint instead of a PIN, and it could be a saviour when your bank server is busy. When the wallet amount is less than the amount payable, you can partially deduct from this bank. It won't hurt to have one.

Why Paytm?

I despise Paytm for its poor performance and Chinese-y UI. However, given his well-established wallet system and virtual bank, he does the job better. Anyway, if you drag the scan widget to the home screen, you can bypass the UI too.

Keep in mind that by doing so, you are not just saving your time but also making the actual payment network less congested. The government did a fair job of introducing and maintaining UPI; now it is your turn. It's worth it to waste your time on earning but not on spending !